Bank of Africa Kenya Internet Banking: How to Register, Login, Services, and Contacts 2024

Access BOA Kenya's Internet banking platform for effortless account management, secure transfers, and exceptional customer service

Internet banking has revolutionized how we handle our money, and Bank of Africa Kenya Limited (BOA Kenya) has embraced this transformation wholeheartedly. This comprehensive article will walk you through registering for BOA Kenya's internet banking, logging in, exploring the services offered, and providing you with essential contact information.

Bank of Africa Kenya Limited, a licensed commercial bank by the Central Bank of Kenya, has been a trusted financial partner since its inception in July 2004. With a dedicated focus on corporate, SME, and retail clientele, BOA Kenya has carved a significant niche. The bank ranks 15th out of the total 42 commercial banks in Kenya, reflecting its substantial presence in the market. Its robust foundation is evident in its total assets valued at Kshs 77.08 billion as of 31 December 2014.

Expanding its reach far beyond Kenya's borders, BOA Kenya operates within the country and in 31 other countries spanning four continents. This global footprint positions the bank as a reliable financial partner for diverse customers.

Services That Empower You from BOA Kenya's Internet Banking

BOA Kenya's internet banking opens a world of convenience and possibilities. Explore a plethora of services that redefine how you manage your finances:

- Account Management: View your balances, transaction history, and detailed movements, all accessible 24/7—download statements for your accounting ease.

- Transfers Made Easy: Initiate domestic and international transfers effortlessly. Attach supporting documents for international transactions, enhancing transparency.

- Beneficiary Management: Securely add new beneficiaries for smoother future transactions.

- Standing Orders: Set up, pause, and stop standing orders at your convenience.

- Bulk Transactions: Whether it's bulk salary transfers, M-Pesa transfers, or PesaLink transfers, BOA Kenya's internet banking streamlines the process.

- Secure and Safe: BOA Kenya prioritizes your security, ensuring that every transaction you make is protected.

Getting Started: Registering for Internet Banking

The world at your fingertips—this is the essence of Bank of Africa Kenya's internet banking. If you're ready to harness the power of this platform, here's how to get started:

Self-Registration Process:

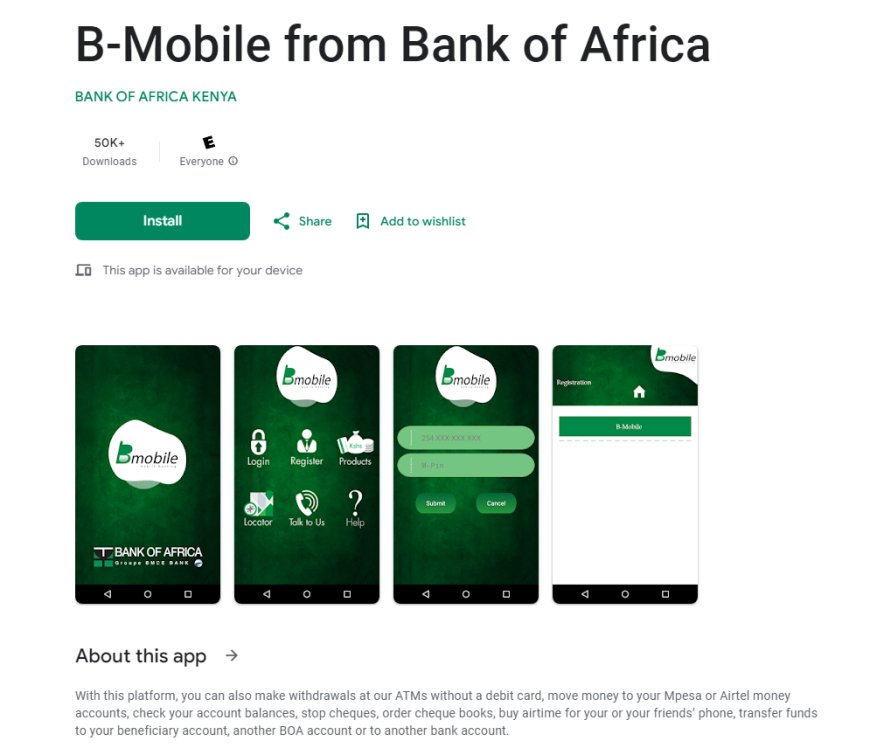

- Download the B-mobile App from the Play Store or App Store.

- Fill in the required details.

- Receive an SMS containing your USERNAME and a one-time PIN.

- Log in using the provided one-time PIN and set a personalized PIN for future use.

- Remember to keep your PIN confidential and avoid sharing it with anyone.

Physical Registration Process:

- Download the B-mobile application form.

- Fill out the form accurately.

- Submit the form at the nearest BOA branch.

Accessing BOAWeb:

Internet banking grants you access to your accounts anytime, anywhere. This 24/7 availability empowers you to issue transaction instructions according to your convenience. Beyond this, BOAWeb offers a host of benefits:

- International transactions and attaching supporting documents for international transfers.

- Access to your account statements for easier reconciliation.

- Secure checkbook requests and bulk transfers.

- Safe and secure transactions, with the option to make bulk Mpesa and PesaLink transfers.

Bank of Africa Kenya Contacts

With over 30 branches strategically scattered across the nation, the bank ensures that its clients can access assistance without the need to travel to the head office. The distribution of Bank of Africa Kenya branches, especially in Nairobi and other major towns, reflects its commitment to providing efficient and timely customer services.

Here's where you can reach out to BOA Kenya:

- Physical Address: BOA House, Karuna Close, Off Waiyaki Way, Westlands, Nairobi.

- Postal Address: PO Box 69562-00400 Nairobi, Kenya

- Telephone: 0703058000 / 0203275000

- SMS: 20030

- Email: yoursay@boakenya.com

READ ALSO: Access Bank (Kenya) Online Banking: Registration, Login, Services, and Contacts

Final Thoughts

In the rapidly evolving world of finance, Bank of Africa Kenya Limited stands as a beacon of reliability and innovation. Its commitment to serving its customers efficiently, combined with its Internet banking prowess, ensures that clients can easily manage their financial affairs. Whether you're a corporate professional or a retail customer, BOA Kenya's internet banking offers a seamless experience tailored to your needs.