itax KRA Portal Registration 2024: Registration, Apply for Your KRA PIN and PIN Retrieval

Say goodbye to manual processes: get your KRA PIN certificate easily from the comfort of your home using the iTax portal

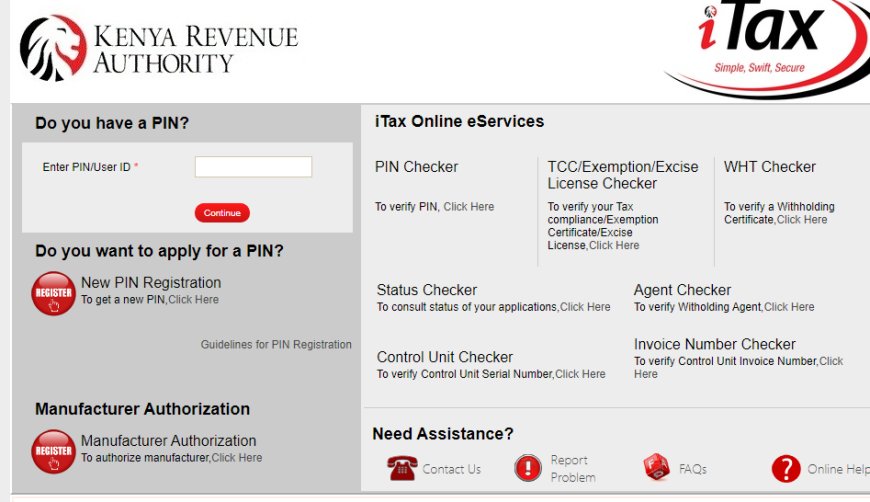

Hello there! Today, we're diving into a topic that's super important for everyone in Kenya - registering on the iTax KRA Portal. Now, you might be wondering, "What's this all about?" Well, the Kenya Revenue Authority, or KRA for short, has this cool online platform called iTax. It's like a one-stop shop for all things tax-related, and trust me, it's something you'll want to know about.

So, why should you care about iTax? For starters, it's where you get your KRA Personal Identification Number (PIN) – a must-have for lots of important stuff like filing taxes, doing business, and even some government services. But it's not just about getting a PIN; iTax is all about making your life easier. It's like having a tax assistant right in your pocket!

In this article, we'll walk you through everything you need to know about iTax and how to get your KRA PIN. We'll cover the basics, give you a step-by-step guide on registering, and even share some tips on managing your iTax account. Plus, we've got answers to those burning questions you might have.

So, whether you're a student, a business owner, or just someone trying to figure out taxes, this guide is for you. Let's make tax stuff less scary and more doable, shall we? Stay tuned!

Understanding iTax and KRA PIN Registration

What is iTax?

Have you ever wished tax stuff could be easier? Well, iTax is like a magic solution from the Kenya Revenue Authority (KRA). It's an online system that lets you handle all your tax activities from your computer or phone. Think of iTax as your personal tax assistant – it's there to make everything simpler and faster. You can file your taxes, check your status, and do a bunch of other important tax stuff without leaving your house. Pretty cool, right?

The Necessity of a KRA PIN

Now, let's chat about the KRA PIN. It's like a special code that the Kenya Revenue Authority gives you. This PIN is super important in Kenya. You need it for all sorts of things – like when you're filing taxes, doing business, or dealing with government services. If you're thinking, "Do I really need this?" Yep, you do! Not having a KRA PIN can make things tricky for you, legally and otherwise. It's not just a bunch of numbers; it's your ticket to being all set with your tax duties.

Step-by-Step Guide to Registering on iTax

Preparing for Registration

Before you jump into registering, it's like getting ready for a small adventure. You need some stuff with you. If you're a resident, grab your ID card. Working folks, you'll need your employer's KRA PIN. Business owners, have your business registration details handy. And for my friends who aren't citizens, your passport and a few other documents will do the trick. It's all about having the right things at hand to make your journey smooth.

The Registration Process

Now, let's get to the fun part – registering! Follow these easy-peasy steps:

- Start Your Journey: Head over to the iTax website - it's your first stop.

- Choose Your Path: Click on "New PIN Registration". Are you an individual or a business? Pick the one that fits you.

- Fill in the Blanks: Now, you've got some basic info to fill in. It's like telling iTax a bit about yourself.

- Check the Right Boxes: You'll see some tax obligations. Tick the ones that apply to you.

- More Details, Please: If you're a business, you'll need to add info about the bosses or partners.

- Do the Math: There's a little arithmetic sum at the end. Solve it and hit submit. And voila, you're done!

How to Print KRA PIN from the iTax Portal

The step-by-step process for retrieving and printing your KRA PIN certificate is straightforward and user-friendly.

- Open the KRA iTax Portal: Begin by visiting the official KRA website's iTax portal section. Have your login credentials at the ready.

- Enter Your KRA PIN: Input your KRA PIN details in the designated User ID/PIN section. If you've forgotten this information, you can request it from KRA, and they'll send it to your email.

- Enter Your Password: Input your iTax portal password and solve a simple arithmetic question (security stamp) to prove you're human. If you've forgotten your password, don't worry – you can reset it.

- Navigating the iTax Portal Dashboard: You'll land on the iTax portal dashboard after successfully logging in. This page offers various functionalities, including e-Registration, My Profile, e-returns, and e-payments.

- Open the Registration Menu: Click on the Registration menu, the second tab on the left. A drop-down menu will appear, and you'll find the Reprint PIN Certificate functionality as the third option. Click on it.

- Choose Applicant Type: Choose either the "Taxpayer" or "Agent" application type, depending on your circumstances. If you're retrieving the certificate for yourself, select "Taxpayer" and proceed.

- Download the Certificate: Your KRA PIN certificate will be generated at this stage. Click on "Click Here to Download PIN Certificate." The certificate will be in PDF format, so ensure you have a suitable PDF reader installed to access it.

Managing Your iTax Account

Retrieving and Updating KRA PIN Certificate

Got your KRA PIN? Great! But what if you lose it or need to update it? No worries, iTax has got you covered. You can easily get your KRA PIN certificate again right from your comfy chair. Just log in to iTax, click a few buttons, and bam – your certificate is ready to download. Remember, keeping your KRA PIN details updated is super important. It’s like making sure your superhero cape is always ready for action!

Filing Returns on iTax

Now, let’s talk about filing returns. It might sound like a big deal, but with iTax, it’s a breeze. Whether you're filing nil returns because you didn’t make enough to be taxed or you’re handling VAT returns because you're rocking it in business, iTax makes it simple. Just log in, pick the right form, fill in your details, and hit submit. Even if you're employed, iTax helps you file using your P9 form. It’s like playing a game where you’re always winning!

Frequently Asked Questions

Let's tackle some common questions about iTax and KRA PINs:

What is a KRA PIN, and why is it important?

- It's like your tax ID in Kenya. Super important for filing taxes, doing business, and more.

Can I retrieve my KRA PIN certificate online?

- Absolutely! Just log into iTax, and you can download it.

What information do I need to retrieve my KRA PIN certificate?

- Have your KRA PIN and iTax password ready. Easy!

Is the KRA PIN certificate available in digital format?

- Yes, you'll get it as a PDF.

How does the iTax portal benefit taxpayers?

- It's all about convenience. Manage your taxes online, anytime.

Can I use the KRA PIN certificate for various transactions?

- Definitely! It's essential for many financial and business activities.

Troubleshooting Common iTax Issues

Ran into a problem? No stress! Here's how to fix some common iTax hiccups:

- Forgot your password? Hit the reset button on the iTax login page.

- Can't find the right form? Check under the 'e-Returns' tab and select the one that matches your needs.

- Error messages? Double-check your info. Sometimes a small typo can cause big problems.

And there you have it! We hope this guide makes your iTax journey smoother. Remember, keeping up with your taxes is important, and iTax is here to help every step of the way. Happy tax filing! ????

READ ALSO: How to File KRA Returns on Your Income in Kenya

Conclusion

In conclusion, the iTax portal has transformed how Kenyan taxpayers interact with the Kenya Revenue Authority. The process of retrieving and downloading your KRA PIN certificate has been simplified and made more accessible through this online platform. By following the step-by-step guide outlined above, taxpayers can efficiently manage their tax-related activities, save time, and enjoy the convenience of digital services. Embrace the power of technology and ensure your KRA PIN certificate is ready whenever needed. Start using the iTax portal today and streamline your tax experience like never before.