Mwananchi Credit Car Financing In Kenya - Everything You Need To Know

Mwananchi Credit Car Financing offers flexible loan amounts and repayment tenures to suit every budget. Discover their seamless application process and personalized support

Buying a car is more than just a purchase; it's a dream for many. But how do you make this dream a reality in the fast-paced economic climate of Kenya? Enter Mwananchi Credit Limited. As an expert in car financing, they bridge the gap between dreams and reality. But what's the catch? Let's dive deep and understand everything there is to know about Mwananchi Credit Car Financing in Kenya.

Why Car Financing Matters

Driving home in your dream car feels fantastic. But can everyone afford to buy a car in one go? This is where car financing comes into play. It allows individuals to purchase their favorite vehicle without paying the entire amount upfront. By dividing the total cost into manageable installments, car financing makes the dream of owning a car feasible for many.

Established as a leading figure in the finance sector, Mwananchi Credit Limited is no stranger to the Kenyan car financing landscape. But what makes them stand out?

Customer-Centric Solutions

They believes in walking the extra mile for their customers. Whether it's about creating a tailor-made loan package or offering personalized advice, Mwananchi Credit Limited ensures you are always a priority.

Diversity in Services

Mwananchi Credit Limited isn't just about car financing. They have services like logbook loans, title deed loans, import financing, and more. This means they cater to diverse financial needs, making them a one-stop solution for many Kenyans.

Seamless Experience

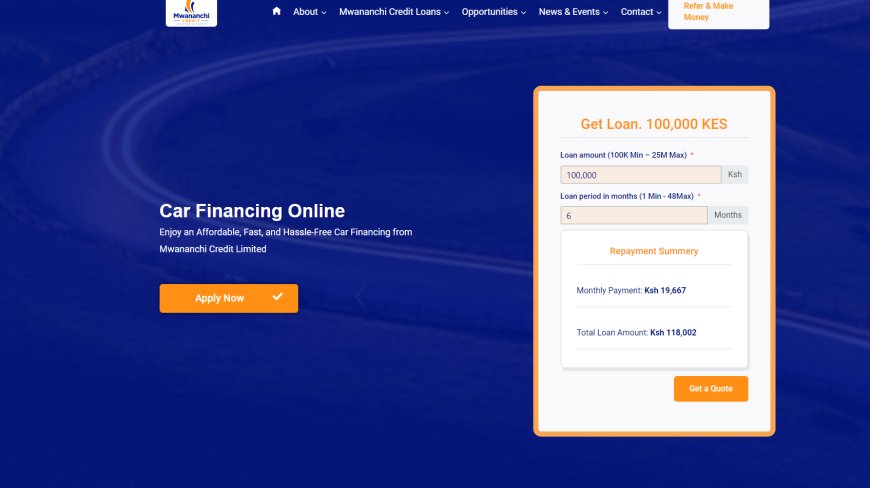

Remember the tedious paperwork and countless visits to the bank? Say goodbye to them! With Mwananchi Credit Limited, you can expect a hassle-free online application process and faster approval times.

Key Features of Mwananchi Credit Car Financing

What sets Mwananchi's car financing apart? Let's break it down:

Variety in Loan Options

From purchasing a brand-new sedan to a second-hand SUV, their diverse loan options cater to all your needs.

Transparent Interest Rates

Hidden charges? Not here. Mwananchi Credit Limited prides itself on providing transparent and competitive interest rates.

Support like No Other

Their dedicated team ensures you are never left with a query. Whether understanding the loan process or seeking repayment advice, they've covered you.

Navigating The World of Car Financing with Mwananchi

While Mwananchi Credit Limited ensures the process is smooth, it's always good to be prepared:

Understand your Needs

Determine the type of car you want, the loan amount needed, and how much you can repay monthly.

Documentation

Ensure you have all necessary documents ready - from identification to proof of income. This speeds up the process significantly. These include:

Seek Guidance

Need help with interest rates or loan types? Don't hesitate to reach out. Their team is always ready to help.

Contact them via:

- 0709147000

- info@mwananchicredit.com

- Ecobank Towers 10th floor

- Muindi Mbingu Street, Nairobi

Flexibility in Loan Amounts

No matter the car of your dreams – be it a sleek sedan, a rugged SUV, or a humble hatchback, Mwananchi Credit understands the varying price brackets. They offer auto financing that spans a broad range: from as low as 150,000 KES to a whopping 25,000,000 KES.

Whether it's a brand-new model fresh off the assembly line or a pre-loved gem, Mwananchi Credit has got you covered. Their financing solutions cater to new and used car purchases, ensuring every Kenyan's dream is within reach.

With repayment tenures stretching up to 24 months, you can drive your dream car and repay the loan in comfortable, bite-sized monthly installments.

READ ALSO: Mwananchi Credit Logbook Loans: How To Apply, Loan Amounts , Requirements And More

Conclusion

In Kenya's vast landscape of car financing, Mwananchi Credit Limited emerges as a beacon of trust, reliability, and excellence. With their array of services, transparent dealings, and commitment to customer satisfaction, they make car ownership a dream for many.

FAQs

1. How quickly can I expect loan approval from Mwananchi Credit Limited?

You can typically expect feedback within 24 hours of submitting your application.

2. What if I already own a car and need immediate funds?

Mwananchi Credit Limited offers logbook loans where your car's logbook can be used as collateral to secure a loan.

3. Are there any hidden charges involved?

No. Mwananchi Credit Limited believes in transparency and ensures all charges are communicated upfront.

4. Can businesses also avail of car financing services?

Yes, Mwananchi Credit Limited offers asset financing for businesses.

5. What makes Mwananchi Credit Limited different from other financial institutions?

Their customer-centric approach, diverse financial services, and transparent dealings make them a preferred choice for many.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a financial expert before making any significant financial decisions.